FUTURE IMPLICATIONS OF THE RECENT RESTRICTIONS IMPOSED ON NON-FILER BY FBR IN PAKISTAN

The FBR in Pakistan has imposed measures regarding non-filers from the 1st of October 2024 and have put the following measures. These restrictions such as no purchase of property, no owning a car, and no foreign travels are intended to stretch out the tax base and improve on revenue mobilization. Nevertheless, the comprehensible long-run effects […]

RESTRICTIONS IMPOSED BY FBR ON FILERS

Removing the non-filers from Pakistan’s tax system is a top priority for the Federal Board of Revenue (FBR). The FBR will apply severe penalties to those who neglect to file income tax returns as of October 1, 2024. The government has taken this decision as part of its ambitious strategy to fulfil an annual target […]

Sales tax practice

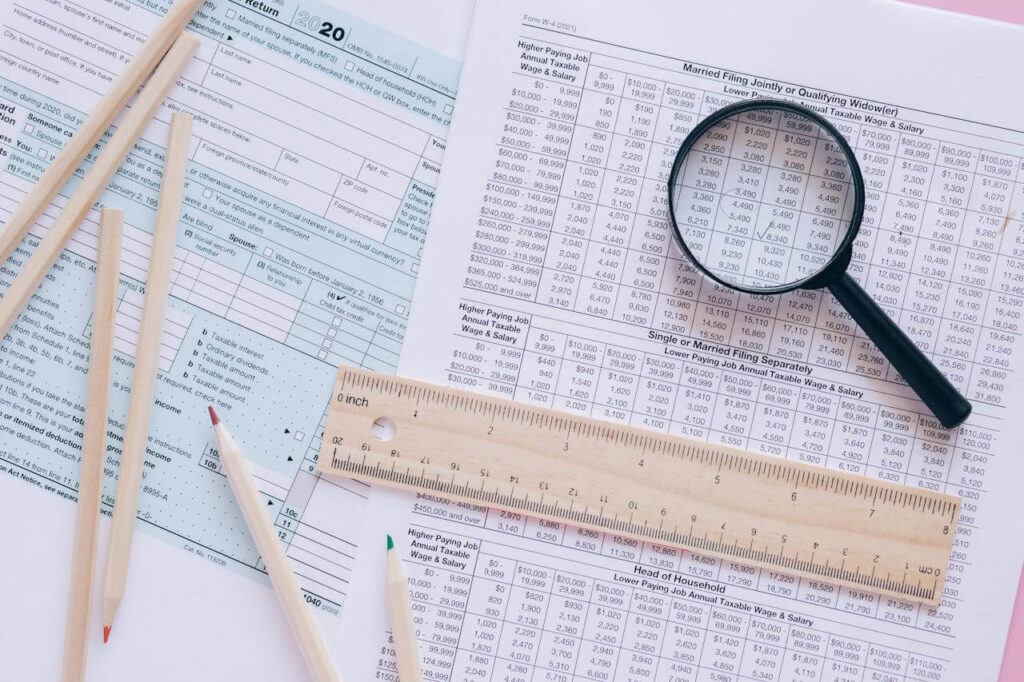

Navigating Sales Tax Practice: What You Need to Know Sales tax is an important part of business operations, whether you’re selling products or services. However, staying on top of sales tax compliance and planning can be a challenge, especially as regulations shift across different regions. In this guide, we’ll walk you through the essentials of […]

Income tax Practice

Mastering Income Tax Practice: A Complete Guide Income tax can be complicated, but it’s something we all need to manage—whether you’re running a business or handling your personal finances. The key to success lies in understanding how to navigate the system efficiently and effectively. In this guide, we’ll break down the essentials of income tax […]